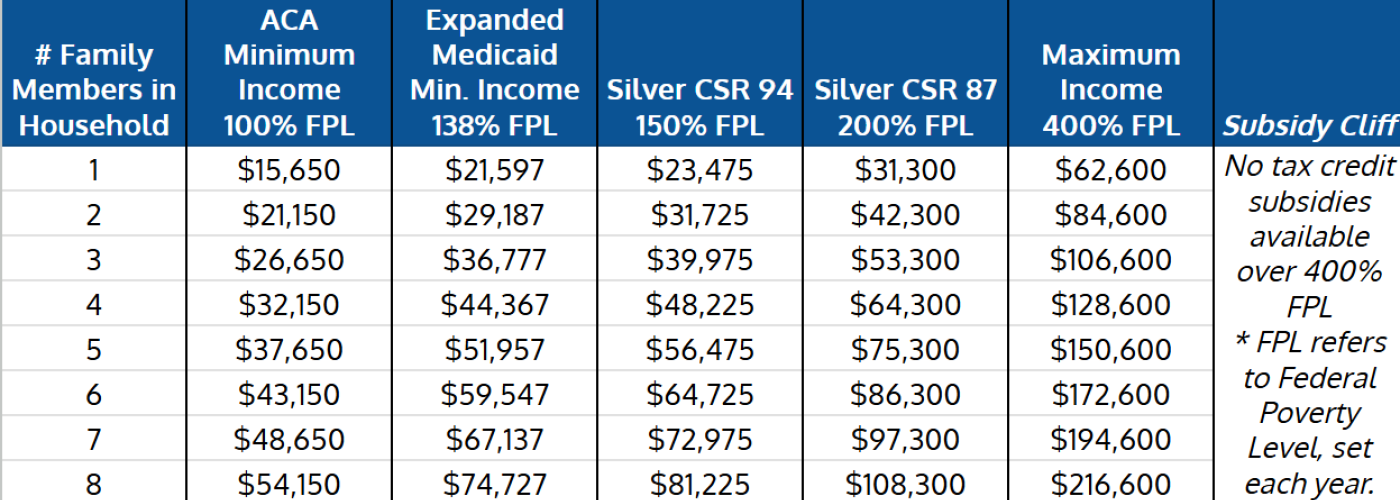

2026 ACA Marketplace Income Limits*

for lower health insurance premiums from Advance Premium Tax Credit Subsidies in 2026

*The current government shutdown is mostly over not extending or making permanent the Enhanced ACA Subsidies that we’ve had since Covid. If the government comes together, net premiums might become lower, especially for those over the 400% FPL “Subsidy Cliff” income limit…

We even made a short story about it:

read “The ACA Stalemate in the Government Shutdown”

read “The ACA Stalemate in the Government Shutdown”

The 2026 ACA Marketplace income limit guidelines have been released and are below. These will be in effect for the 2026 Open Enrollment and Special Enrollment Periods for ACA Marketplace health insurance for most states, some states have slightly different figures. Contact us for details or questions in your own state.

Click on the image below to enlarge

2026 ACA Income Limits for Tax Credit Subsidies

| Family Size | 100% FPL | <138% FPL | 150% FPL | 200% FPL | 400% FPL |

|---|---|---|---|---|---|

|

Family Size:

1 |

100% FPL:

$15,650 |

<138% FPL:

$21,597 |

150% FPL:

$23,475 |

200% FPL:

$31,300 |

400% FPL:

$62,600 |

|

Family Size:

2 |

100% FPL:

$21,150 |

<138% FPL:

$29,187 |

150% FPL:

$31,725 |

200% FPL:

$42,300 |

400% FPL:

$84,600 |

|

Family Size:

3 |

100% FPL:

$26,650 |

<138% FPL:

$36,777 |

150% FPL:

$39,975 |

200% FPL:

$53,300 |

400% FPL:

$106,600 |

|

Family Size:

4 |

100% FPL:

$32,150 |

<138% FPL:

$44,367 |

150% FPL:

$48,225 |

200% FPL:

$64,300 |

400% FPL:

$128,600 |

|

Family Size:

5 |

100% FPL:

$37,650 |

<138% FPL:

$51,957 |

150% FPL:

$56,475 |

200% FPL:

$75,300 |

400% FPL:

$150,600 |

|

Family Size:

6 |

100% FPL:

$43,150 |

<138% FPL:

$59,547 |

150% FPL:

$64,725 |

200% FPL:

$86,300 |

400% FPL:

$172,600 |

Figures are based on Modified Adjusted Gross Income, or MAGI. For a completely different kind of article, we invite you to read “The Gift of the Magi” by O. Henry, or William Sidney Porter.

Eligible individuals and families with incomes between 100% and 400% of the FPL guidelines qualify for subsidies.

Simply put… ‘the less income you have inside the box, the more help you get: it’s a sliding scale’.

For more information, call us at 828-372-0101 or schedule a free consultation.

The amount of tax credit subsidy and the health insurance plans available to enroll in will depend on family size and income. Cost-share reduction (CSR) or ‘Silver Enhanced’ plans are available between 100% and 250% FPL.

What is the Federal Poverty Level (FPL)?

100% – 400% of FPL

Up to 250% of FPL

What Are Advanced Premium Tax Credits (APTCs)?

Advanced Premium Tax Credits (APTCs) help lower the cost of your health insurance premiums. The amount of the credit is based on your estimated annual income and household size compared to the FPL. APTCs are sent directly to your health insurance provider, reducing the premium amount you owe each month.

Who qualifies?

Individuals and families with incomes between **100% and 400%** of the FPL can qualify for APTCs.

How are they calculated?

APTCs are designed to ensure that your premium costs do not exceed a certain percentage of your income, based on a sliding scale.

2025 Example

A single individual with an income of $30,000 (approximately 200% of FPL) may pay as little as 2-4% of their income on premiums.

Reconciling APTCs on Your Tax Return

When you receive APTCs, you’ll need to reconcile the amount you received with your actual income when you file your taxes. Here’s how it works:

Form 1095-A

This form is sent to you by your health insurance Marketplace. It lists the details of your coverage, including the APTCs you received.

IRS Form 8962

Use this form to compare the APTCs you received throughout the year to the amount you were eligible for based on your actual income.

Overpayment or Underpayment

If you underestimated your income and received more APTCs than you were eligible for, you may need to pay back some of the credit. If you overestimated your income, you could receive a refund of any APTCs you didn’t claim.

It’s crucial to report any income changes to the Marketplace throughout the year to avoid surprises during tax season.

Why Hummingbird Insurance?

At Hummingbird Insurance, we specialize in helping individuals and families navigate the complexities of the ACA Marketplace. Whether you’re looking for guidance on 2025 ACA income limits, help applying for APTCs, or understanding the reconciliation process during tax season, we’re here for you.

Free Consultations & Expert Advice

We offer free consultations to review your coverage options and ensure you’re maximizing your savings. Our licensed agents are experts in ACA Marketplace, Medicare, and Group Benefits.